What does life insurance not cover?

Although life insurance is there to protect us when we pass away or become diagnosed with a terminal illness, there are some situations where a life insurance policy will not cover you. Below are some examples where your insurance policy may not cover you, even if you die.

- If you stop paying your insurance premiums or if you are unable to keep up with the annual increase from index-linked cover.

- Total disability – often included within a critical illness policy only

- Death by Suicide, if you are within the first 12 months of the policy start date

- Policy cancellation. If you cancel your life insurance policy, you and your family will no longer be covered unless you have another policy in place

- Critical illness – these conditions are covered with a separate critical illness policy which we can advise on

- Outliving your policy term – If you have taken out term life insurance and you outlive the term, no payout will be made and you may need to find new cover to protect you for the remainder of your life.

Remember, every policy differs in its terms and conditions so you should make sure you fully understand the details of your insurance policy and make sure you have the right type of cover.

When is the best time to get life insurance?

You can take out life insurance at any age and there are advantages to taking out protection from an early age.

Many financial experts recommend that you take out life insurance before you reach 35. After this age, both premiums and health conditions will likely rise. Your choice of cover may also be limited, especially if you begin to suffer from medical conditions associated with ageing. If you are over 30 years old and don’t have any form of life cover it could be worth considering.

The younger you are when you apply for a life insurance policy the more likely you will be locking in lower premiums compared to applying in later life.

However, you can apply for life insurance at any age and we regularly speak to people looking for over 50’s life cover.

Ultimately it is a personal decision and there is no right or wrong time to take out life cover. If you have responsibilities like a mortgage, family or any dependants, life cover can offer peace of mind.

What life insurance plan is best for me?

If you want the best life insurance policy for your specific circumstances, it is worth speaking to a qualified adviser. There are many different types of life cover and it is important you choose the right cover for your needs – both now and in the future.

If you are looking for the best type of life cover it may be worth asking yourself these 3 questions:

· How long do you need life cover for?

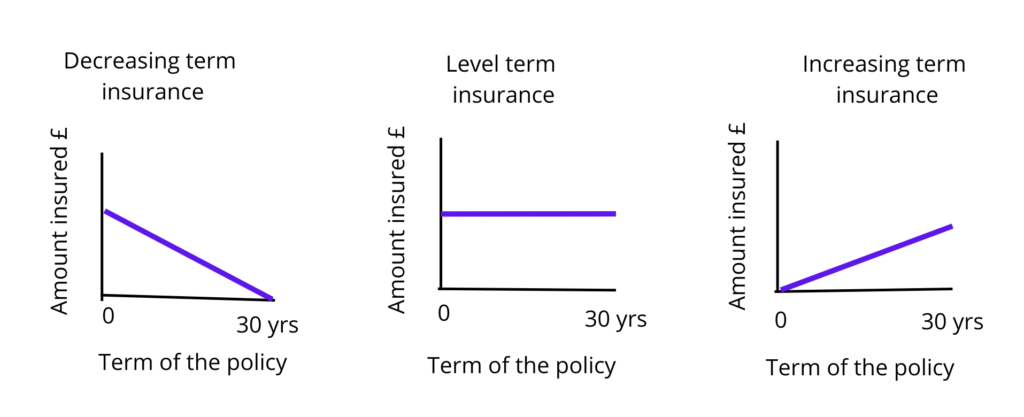

· What kind of payout do you want?

· How much cover would you like?

Depending on your circumstances, you may also want to consider inheritance tax planning to ensure that your loved ones receive the most benefit. If you want to find out more about inheritance tax planning and products like Gift Inter Vivos, speak to our expert team.