Future Proof is an award-winning firm providing expert Protection Advice. We have been trusted to provide Life Insurance, Critical Illness, Income Protection and Business Protection advice by several blue-chip companies such as NFU Mutual and AIG Life

Our attention to detail, customer focus and ethical approach have resulted in us winning several National awards over the years, including:

Legal and General 13th annual Legal & General Business Quality Awards – Winner – Outstanding Customer Outcome (Large Intermediary Category 2023)

Protection Guru – Winner – ‘Best Growth in Protection 2023’

Cover Women In Protection and Health Award – Winner ‘Adviser of the Year 2022’ Karen Searle

Protection Review award – Winner – ‘Protection Intermediary of the Year 2022’

You will earn

Award-winning advice and outstanding customer journeys

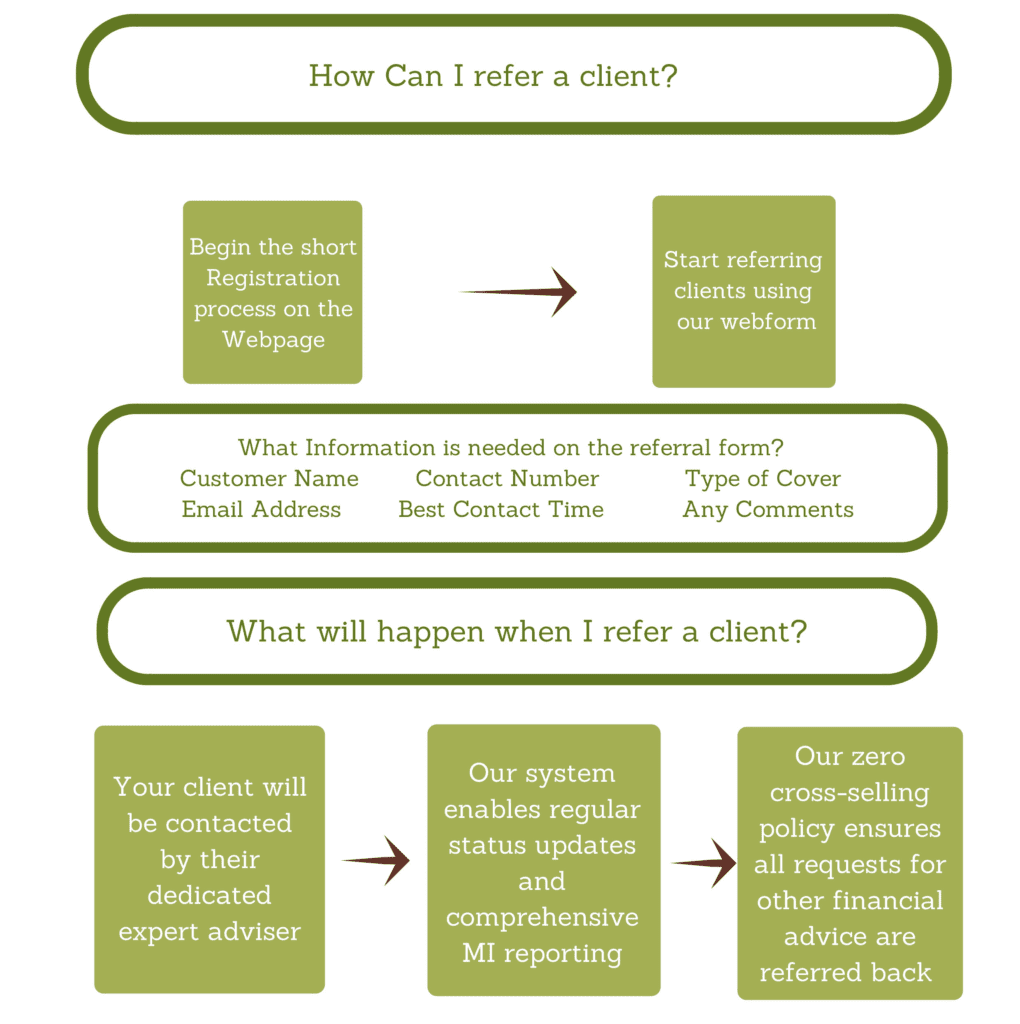

We only talk to clients about their Protection needs which means there is no risk of cross-selling. It helps to ring-fence your clients with all potential leads being referred back to you.

Here at Future Proof we’re passionate about Protection, we help clients to:

- underpin their investments against the threat of dying or critical illness

- protect their income

- cover any mortgages, business debts and potential IHT liabilities

- or simply to provide for their family

“NFU Mutual has enjoyed the benefit of a relationship with Future Proof Ltd since 2016, and during that time, the service received has been nothing short of excellent.

The dedication and customer-focus shown by David and his team is matched by their knowledge and expertise.

Future Proof’s panel of providers has enabled the placement of cover for some of our customers who have experienced trouble finding cover elsewhere due to medical conditions or high-risk hobbies.”

Testimonial from Graham Harvey, Head of Financial Services Distribution, NFU Mutual.

“AIG Life has worked with Future Proof Insurance since its inception in 2011 and we count them as one of our most trusted partners. We have been continuously impressed with their highly personalised approach to identifying customer need and providing holistic, quality protection advice. They really do put the customer first and always aim to find the best possible customer outcomes. They do not shy away from customers with impaired lives, but strive to find a tailored solution that meets their need, taking great care to explain how premiums have been calculated.

Future Proof’s website is user-friendly and their blogs provide quality, easy to access information on how customers with particular medical conditions can still get protection insurance. Their customer-first approach has been recognised by a number of industry and service awards, and we wish them continued success and recognition.”

Testimonial from Vicky Churcher, Intermediary Director, AIG Life

“When my client felt they had no other option, David stepped in and mentioned Futureproof.

The knowledge and expertise was second to none and I really felt like my client was well taken care of and had a plan now and in the future. ”

Testimonial from:

Ruth Downs BA (Hons) DipPFS

Financial Adviser

‘Future Proof have been providing my clients with protection advice for more than 3 years, no hard sell, just honest open advice which is at the heart of what they do.’

Testimonial from:

Gary Lounton

Eastshore Mortgages

Why choose Future Proof?

Future Proof Insurance was established in October 2011. We provide high quality impartial Advice on Income Protection, Critical Illness Cover, Life Insurance and Gift Inter-Vivos. We also provide advice relating to Business Protection Insurance and Key Man Insurance.

Since our inception we have arranged in excess of £650 million of insurance cover for over 5,000 customers, with 21 insurance companies, including; Aegon, AIG Life, Aviva, Legal & General, LV=, One Family, Royal London, Vitality Life and Zurich.

Our award-winning team has an excellent understanding of unusual underwriting requirements, and regularly help to arrange cover for people with chronic medical conditions and unusual & high risk occupations (in some cases clients may have had an application rejected before coming to us). We regularly publish case studies on our blog illustrating how we have helped people with challenging situations to arrange cover.

We have impressive strategic partnerships in place, we provide outsourced protection advice and servicing to all NFU Mutual clients through a branch network of over 300 agencies and 1000 advisers. NFU Mutual have seen a substantial increase in Protection enquiries which has provided income from previously untapped sources. We have been instrumental in reducing deal handling times and reducing their in-house costs.

We have a successful long-term partnership with AIG Life, we provide ongoing servicing and support for over 44,000 clients (for 55 orphaned agencies). We have recently renewed this 5 year partnership affirming Future Proof’s reputation in the market as a respected and valued partner.

We are experienced in working with any potential partners to complete strict and extensive due diligence processes.

-

Life is uncertain and our aim is to provide our customers with the peace of mind that they have financial security in times of need. We are here to help protect them and their family. We are advisers, not sales people. We create trust with our customers and build long-term relationships by placing them at the heart of any advice we provide and providing 1st Class service. We like to think that we are friendly, approachable and professional! We can provide a white-label intermediary service or you can use the Future Proof brand for your Protection business.

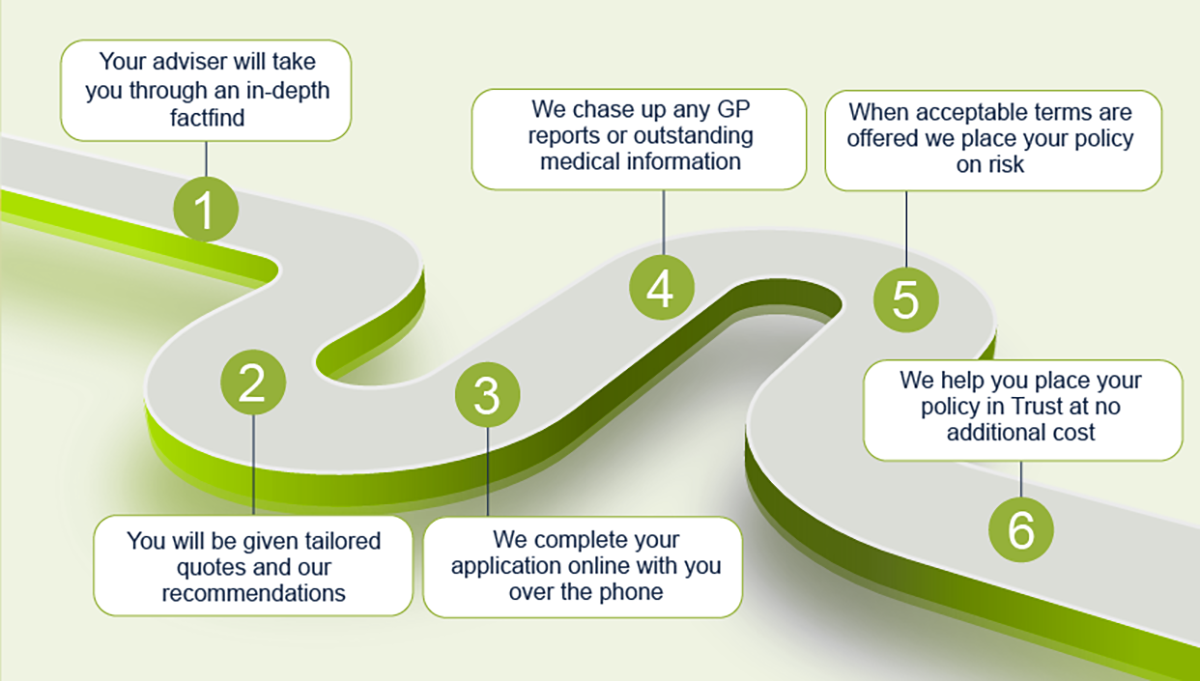

Our award winning process ensures an excellent customer journey and positive outcomes. We are not interested in a hard sell. No matter how complex their medical history or financial needs we have the expertise and experience to offer a clear solution.

We deal with all clients sympathetically, managing the whole underwriting and application process from start to finish, as well as placing plans into Trust.

Client care is fundamental to our success and we have designed a comprehensive multi-media contact strategy. This ensures customers remain fully aware of the products they have purchased and the value they provide resulting in exceptionally high retention rates.

-

We give clear and accurate advice about life insurance products so that each customer understands what a product covers and any limitations it may have. We employ and refer to current technologies such as CI expert and Solution Builder to compare products. A minimum of 10% of client files are checked by our compliance department. We also closely monitor NTU rates and cancellation from inception ratios which are under 3%. To encourage good practice, advisers do not receive commission but earn an annual bonus based on persistency, compliance and profitability. We are happy to assist with any due diligence on our TCF process and company data security.

-

Future Proof will pay the Introducer 30% of any commission we receive as the result of any client you refer to us.

We are happy to pay commissions on an Indemnity or a Non-Indemnity basis.

‘Premier members’ will be paid a volume bonus (but will also take into account retention rates) on a 6 monthly basis (to be negotiated).

Commissions will be paid monthly.

A detailed monthly commission and pipeline statement will be provided.

-

You may only need a transactional, non-advised online quote service for your customers or at the other end of the spectrum we can provide dedicated account management with a fully advised service.

Our website hosts an online Quote function offering quotes for all products including Life Insurance, Critical Illness Cover, Income Protection, Whole of Life and Family Income Benefit.

After a client requests a quote, they receive an automated email and can download a personalised illustration.

We build ongoing relationships with our Partners’ customers by providing not only the best advice but also outstanding after-sales care. We employ a dedicated Customer Services team and administration team to ensure the customer journey is smooth resulting in fantastic customer engagement.

Our awards cabinet